Successful FOREX Scalping 5 Minutes Strategy.

# Use only 5 minutes charts for this Strategy.

# Use Bollinger bands indicator.

# Use MACD indicator.

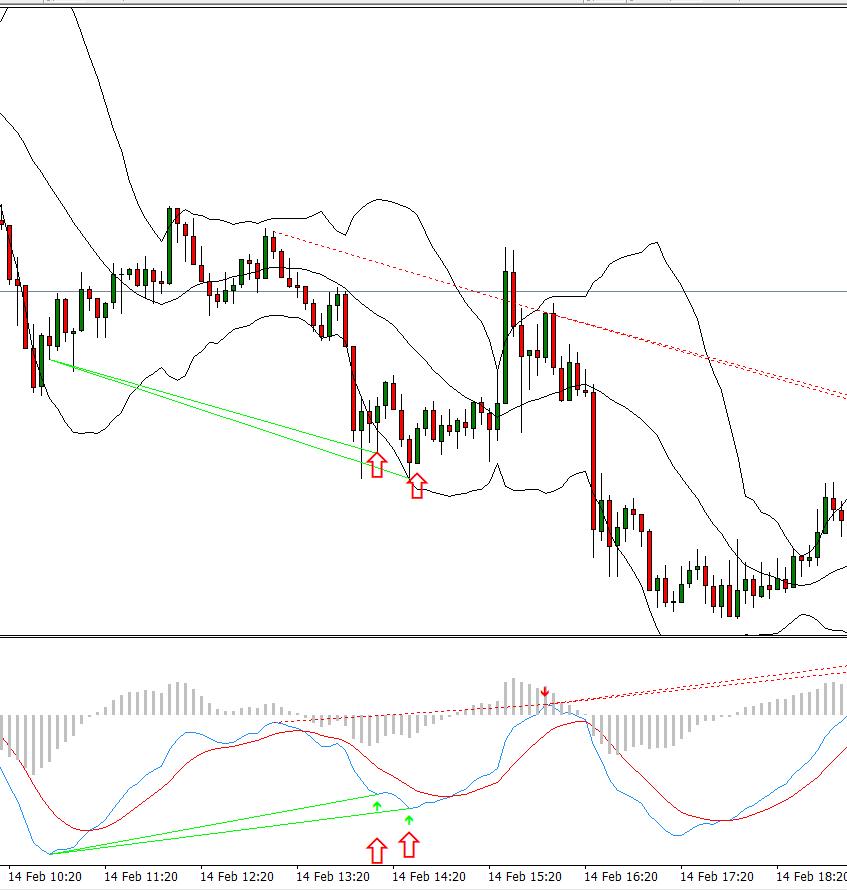

For a buy trade we MUST wait for price to reach the bottom Bollinger bands area either by just touching or for best results going outside the bands area, next we must wait for a divergence signal to appear on the MACD indicator see picture below.

*Important each signal is separate so if there is 3 signals in a row at the same area we take all 3 for best results*

As you can see price drops and goes outside the bands area and then you get a divergence signal this is 2 buy signals.

For a Sell Signal we look to do the opposite from a buy signal that is we wait for price to either touch or go outside the top bands area and then when we get a MACD divergence signal we enter see picture below.

As you can see price goes outside the bands area on 3 separate occasions and we get 3 entries nice watch the video many times.

Where to Place Your Stop Loss

Ok you will be placing your stop loss either in 2 areas just above/below the entry candle give it a 5 pip buffer or 1 high/low above/below the entry candle watch the video in the course I explain in better detail.

Where To Take Profits

When in a buy signal we will follow price to it reaches or goes outside the top Bollinger bands area and after it has reached this area we will close the position after the first RED candle that closes back inside the bands area see picture below

As you can see price goes outside then closes back inside close on the red candle only if continues to print green candles stay in trade to maximize profits.

And vice versa on a sell trade we will let price drop to the bottom bands area then wait for a green candle to close back inside the bands area I go through this is great detail In the course video,

It’s a very simple yet effective method that works it has a high probability outcome with winning positions around 80% plus.

Always remember to manage your risk well and place the stop losses when taking the trades and this system will work miracles for you.

Wishing you all the best in your trading

RISKS ASSOCIATED WITH FOREX TRADING

Trading foreign currencies can be a challenging and potentially profitable opportunity for investors. However, before deciding to participate in the Forex market, you should carefully consider your investment objectives, level of experience, and risk appetite. Most importantly, do not invest money you cannot afford to lose.

There is considerable exposure to risk in any foreign exchange transaction. Any transaction involving currencies involves risks including, but not limited to, the potential for changing political and/or economic conditions that may substantially affect the price or liquidity of a currency. Investments in foreign exchange speculation may also be susceptible to sharp rises and falls as the relevant market values fluctuate. The leveraged nature of Forex trading means that any market movement will have an equally proportional effect on your deposited funds. This may work against you as well as for you. Not only may investors get back less than they invested, but in the case of higher risk strategies, investors may lose the entirety of their investment. It is for this reason that when speculating in such markets it is advisable to use only risk capital.

Risk Disclaimer for Forex Trading

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Past performance is not indicative of future results. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Benefits and Risks of Leverage

Leverage allows traders the ability to enter into a position worth many times the account value with a relatively small amount of money. This leverage can work with you as well as against you. Even though the Forex market offers traders the ability to use a high degree of leverage, trading with high leverage may increase the losses suffered. Please use caution when using leverage in trading or investing.

If your looking for trading systems that work, then start using the 1000pip Climber Forex system now and you could take a step towards FX success.

3 Comments

This is the right site for anybody who wishes to find out about this topic. You understand a whole lot its almost hard to argue with you (not that I really will need toÖHaHa). You certainly put a brand new spin on a subject thats been written about for many years. Wonderful stuff, just great!

This is the perfect blog for everyone who hopes to understand this topic. You understand so much its almost hard to argue with you (not that I actually would want toÖHaHa). You definitely put a new spin on a topic which has been written about for years. Excellent stuff, just excellent!

Thanks for the helpful content. It is also my opinion that mesothelioma has an really long latency period of time, which means that warning signs of the disease might not emerge until eventually 30 to 50 years after the preliminary exposure to asbestos fiber. Pleural mesothelioma, that is the most common sort and influences the area across the lungs, may cause shortness of breath, breasts pains, including a persistent cough, which may produce coughing up our blood.