Learn Forex Trading Strategies And Earn Consistently

An introduction about FOREX

‘Forex’ (foreign exchange) is the term used when one currency is traded for another. So in order to understand Forex we must first explain what a currency is. Currency refers to the unit of money issued by a country or region. We use currency to buy products and services etc. So if we are in from Spain and use Euros (€) and then visit the USA it is necessary to exchange our Euros for US dollars. Globally around $3-5 trillion is exchanged per day. Banks, governments and business are the primary market participants. As we can see from the example above, currency transactions are carried out between pairs of currencies and with one currency being bought and the other sold. In the example above, Euros are being sold and US dollars are bought. Forex traders usually refer to the two currencies being exchanged as a ‘currency pair’. The exchange rate (often called the ‘price’) of the currencies determines the amount of currency we can buy when selling another.

Summary: Forex describes when one currency is exchanged for another. The exchange rate of two currencies is called the ‘price’ of the currency pair.

It is possible to make profit / loss by speculating on whether the price of a currency pair will go up or down

Calculating profits / losses

The amount of profit / loss we make is proportional to how much how much the price has changed and the amount of currency that we are trading. But it is important to note that we can also lose money from Forex trading. If the price moves in the direction we speculate in, we could make money but if the price moves in the opposite direction to the direction we speculate in, we will lose money. Forex traders use the ‘pip’ as a unit to measure price changes. This unit is usually defined as the fourth decimal place of price*. This means that 1pip is 0.0001. For example, if the price of the Euro : US dollar pair changes from 1.1517 to 1.1511, the price has decreased by 0.0006, which is 6 pips. It is important to note that if a currency pair is expressed to 2 or 3 decimal places by the broker, a pip is usually the second decimal place of the price. To be 100% sure, we will need to check with the broker we are using to be sure of how they define a pip. The ‘pip value’ is the amount of money that our account will change by per pip that the price changes. Pip value is proportional to the amount of currency that we want to trade and it can be specified before a trade is opened.

The amount of profit / loss we make is proportional to how much how much the price has changed and the amount of currency that we are trading. But it is important to note that we can also lose money from Forex trading. If the price moves in the direction we speculate in, we could make money but if the price moves in the opposite direction to the direction we speculate in, we will lose money. Forex traders use the ‘pip’ as a unit to measure price changes. This unit is usually defined as the fourth decimal place of price*. This means that 1pip is 0.0001. For example, if the price of the Euro : US dollar pair changes from 1.1517 to 1.1511, the price has decreased by 0.0006, which is 6 pips. It is important to note that if a currency pair is expressed to 2 or 3 decimal places by the broker, a pip is usually the second decimal place of the price. To be 100% sure, we will need to check with the broker we are using to be sure of how they define a pip. The ‘pip value’ is the amount of money that our account will change by per pip that the price changes. Pip value is proportional to the amount of currency that we want to trade and it can be specified before a trade is opened.

If we then make a trade with a broker, it is open until we decide that we want to close it or the “stop loss” or “take profit” is reached, we will explain these terms later. It is only when the trade is closed that we take our profits or losses. The equation to calculate profit can be summarised as follows: Profit/Loss = Pip value x Change in price (measured in pips)

An important but often overlooked aspect of trading is that whenever we trade using a broker, the price at which we will be able to buy a currency pair (called the ‘Ask’ price) will be slightly different to the price at which we are able to sell a currency pair

(called the ‘Bid’ price). The Ask price will be higher than the Bid price and the difference between the Ask and the Bid price is called the ‘spread’. Most currency pairs have a typical spread of 1-3 pips. This is effectively the fee that we pay the broker for making a trade. When we open a trade we have to use the Ask / Bid price but when we close this trade we will have to use the other price (Bid / Ask). This means that we will always close a trade with less pips than the price has moved. The example below shows this in more details

Currency pair: GBPUSD Trade direction: Price will increase

Prices at Time of opening trade Ask price: 1.3022 Bid price: 1.3020

Prices at Time of closing trade Ask price: 1.3043 Bid price: 1.3041

Pip unit: 1 pip is defined as a 0.0001 Spread: 2 pips

Profit/Loss (in pips) = Bid price at close – Ask price at open = 1.3041 – 1.3022 = 0.0019 = 19 pips Actual change in price = Ask price at close – Ask price at open = 1.3043 – 1.3022 = 0.0021 = 21 pips

As we can see the Ask price actually increased 21 pips but because of the 2 pip spread, we only made 19 pips profit because we had to close the trade at the Bid price, which is 2 pips lower than the Ask price.

Summary: Profit/Loss is equal to the pip value multiplied by the change in price (in pips). When we open a trade we have to use the Ask / Bid price but when we close this trade we will have to use the other price (Bid / Ask)

The importance of using a stop loss and take profit

It is very important to control our potential losses when trading. It is essential that we decide upon a price at which we will close the trade if the price moves in the opposite direction to which we predicted. If this price is reached then we will close the trade and minimize our losses. This price is called the stop loss price. Forex brokers will allow us to specify this price when a trade is opened. The broker should then automatically close the trade if this price is reached (we then say that the trade was stopped out) It is also possible to set a price at which we want the trade to close if the price moves in the direction we predicted (i.e. the trade will close in profit). As with the stop loss, the broker will allow us to specify the take profit price when we open a trade, they should then automatically close our trade if this price is reached.

It is very important to control our potential losses when trading. It is essential that we decide upon a price at which we will close the trade if the price moves in the opposite direction to which we predicted. If this price is reached then we will close the trade and minimize our losses. This price is called the stop loss price. Forex brokers will allow us to specify this price when a trade is opened. The broker should then automatically close the trade if this price is reached (we then say that the trade was stopped out) It is also possible to set a price at which we want the trade to close if the price moves in the direction we predicted (i.e. the trade will close in profit). As with the stop loss, the broker will allow us to specify the take profit price when we open a trade, they should then automatically close our trade if this price is reached.

Summary: We can try to reduce our potential losses by setting a ‘stop loss’ price. Setting a ‘take profit’ price enables us to automatically exit profitable trades.

Trailing stop loss

Some brokers will also allow a ‘trailing stop’ to be set on a trade. A trailing stop is similar to the stop loss, in that it is a price level at which the trade should automatically close if the price of the currency pair reaches this level. But rather than being set at a constant price level, the trailing stop can move, but only in the direction in which we have opened a trade. The trailing stop is set to be a fixed number of pips away from the maximum / minimum price that the currency pair has reached after a trade is opened. This means that as the price moves in the direction in which we opened a trade, the trailing stop will move in that direction too, and by an equal amount. For example, we open a Sell trade on the Euro Pound – US dollar pair at a price of 1.3015 and set a trailing stop of 10 pips. The stop will initially be at 1.3025 (10 pips above the opening price). If the price of the currency pair falls 15 pips to 1.3000, the trailing stop will have moved to 1.3010. This is 10 pips above the minimum price achieved since we entered the trade. If the price of then pair rises, the trailing stop will stay at the same price level and should automatically close the trade if the price reaches 1.3010.

Summary: It is essential that a stop loss price is set when entering any trade. A take profit price can also be set. A trailing stop is a movable stop loss.

How to make a trade with a Forex broker

Each brokers’ website (commonly called platform) is slightly different but we will now discuss what generally happens when a trade is opened.

1. Choose a currency pair to trade. The names of currency pairs listed on a broker are typically shortened to 6 characters long. For example the British pound sterling – US dollar currency pair is shortened to GBPUSD, and the Euro – US dollar currency pair is shortened to EURUSD Typically, if we click on a currency pair a ‘deal ticket’ will pop up. This is where we set the requirements about a trade before we open it. 2. Select a trade size When entering a trade the first thing we should specify is the trade size. Some brokers will require that we enter a ‘Stake size’ whereas others will require a ‘Lot size’. The ‘Stake size’ is usually equivalent to the pip value. The ‘Lot size’ is usually a measure of the number of units of the currency pair that we want to trade with. In order to input the correct Stake / Lot size, it is essential that we understand what our broker requires and how our broker will use the selected value to calculate profits and losses. If this is unclear from the brokers website, contact the broker directly, they will be able to advise further. 3. Specify the stop loss We will need to specify the price of our stop loss 4. Specify the take profit level We will need to specify the price of our take profit

5. Open the trade Market order – If we want the trade to open immediately at the current market price then we typically need to follow the following steps: To speculate that the price will rise, we will click on a button that says ‘Buy’. We will have opened a ‘buy trade’. To speculate that the price will fall, we will click on a button that says ‘Sell’. We will have opened a ‘sell trade’. Pending order – It is also possible to specify a price at which the trade will only be opened if the price reaches specified level. This type of order is called a pending order. There is often a tick box in the deal ticket that can be selected if we want to use a pending order. If a pending order is selected we will then need to specify the requested open price of the trade.

6. Close the trade If we wish to close the trade before the price reaches the stop loss or take profit level, this usually involves opening the deal ticket again and selecting ‘Close

Choosing a Forex broker

Our choice of Forex broker is extremely important. Here are four things we think about before choosing one 1. Spread on the currencies we want to trade – we want this to be as small as possible because this is how much we are charged every time we trade. 2. Minimum stake size – we want the minimum stake size to be equal to or less than the stake size we are want to trade with. 3. Ease of use of platform – we need to have a platform where we can easily open / close trades, and change stops. 4. Regulation – We only trade with properly regulated brokers. We are based in the UK and prefer to use brokers regulated by the UK FCA. We may then be entitled to compensation if the company goes into liquidation For the trading strategy described in this guide it is important to use a reliable broker that has low spreads on a number of different currency pairs. ‘1 Light FX’ regularly check which broker is the best to trade with. The one that we currently recommend (and are using ourselves) will be detailed in the introductory email that was sent to you.

Summary: It is very important to choose the right Forex broker to trade with

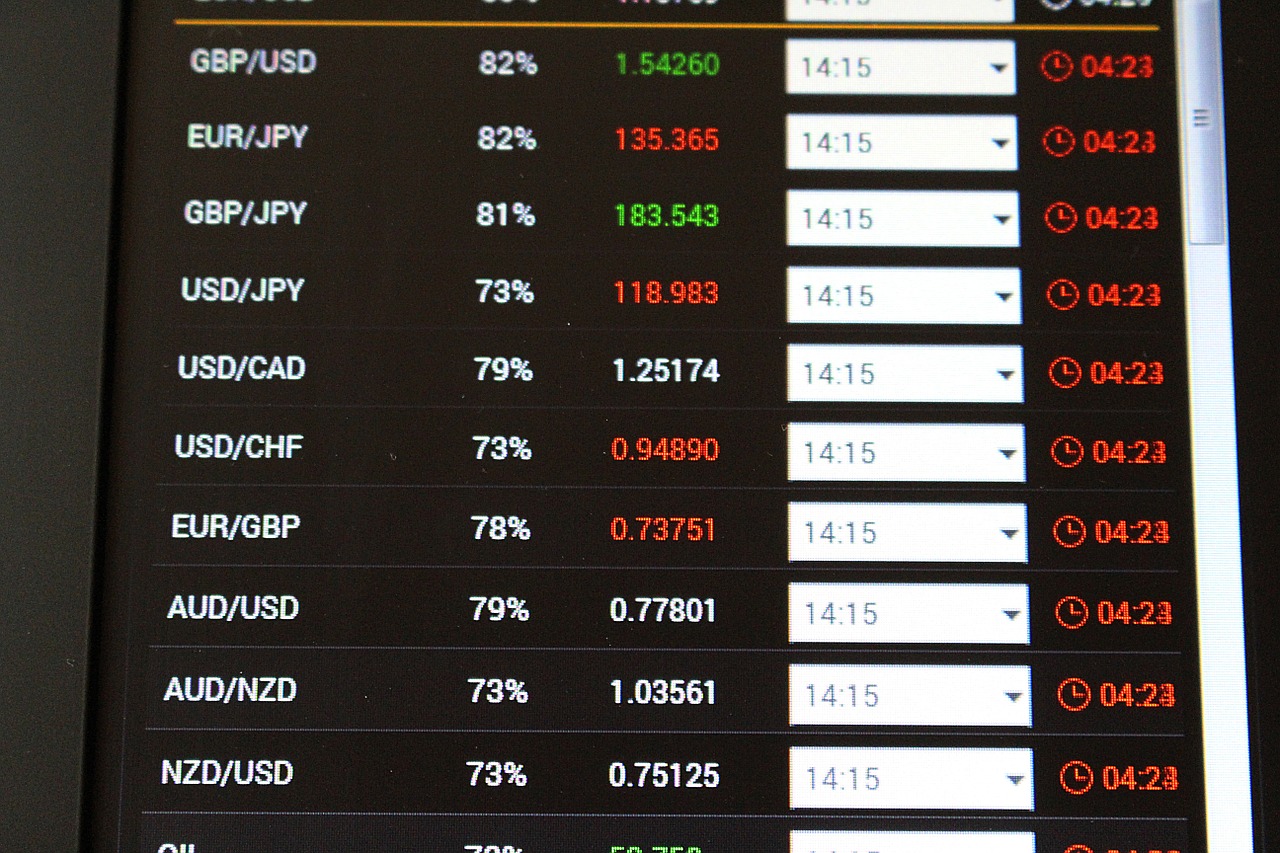

Which currency pairs to trade

There are a vast number of different currency pairs that can be traded. A key part of trading is choosing the right currency pairs to trade. To trade successfully we do not need to trade a vast number of different currency pairs. The more pairs we trade, the less time we can dedicate to understanding each pair. Institutional traders may only trade one or two currency pairs. We find that it is best to choose between 2-6 currency pairs to monitor and consider trading.

There are a vast number of different currency pairs that can be traded. A key part of trading is choosing the right currency pairs to trade. To trade successfully we do not need to trade a vast number of different currency pairs. The more pairs we trade, the less time we can dedicate to understanding each pair. Institutional traders may only trade one or two currency pairs. We find that it is best to choose between 2-6 currency pairs to monitor and consider trading.

When choosing a currency pair to trade there are two key things to consider: We only want to be trading currency pairs that have a low spread (1-3 pips). The lower the spread the better. It is best to trade a currency pair that has at least one of the major currencies in it (Euro, US, dollar, Japanese Yen). These pairs are the most widely traded and are less susceptible to erratic price movement. The PCS has been specifically designed for operation on the following currency pairs: EURUSD, EURJPY, AUDUSD, USDCAD, USDJPY, USDCHF. Each currency pair has its own ‘character’. This means that the price of different currency pairs will change by different amounts and at different rates. The PCS is designed to take this into account when identifying signals for each currency.

Summary: We only want to speculate on widely traded currency pairs that have a low spread. It is possible to only trade one currency pair and still be successful.

A perfect strategy for Forex trading is the one that helps you to learn how you can enter or exit from the trading world. These strategies are adjusted with some series of technical indicators that will help you to identify some key prices stages or levels. If you do a little research, you will be finding an excellent series of fantastic Forex trading strategies that are worth to use for earning consistently. For buying and selling a pair of currency successfully, it is essential to take into account and learn Forex trading for beginners for smooth working.

Significant Reasons to Choose Forex Trading Strategies

- Reliable Forex trading strategies are useful to make you learn about the trade timings. They can make you learn about the best time to step into the Forex market for buying and selling the currencies.

- You can understand your trading objective with the help of perfect Forex trading strategies. This is much needed to have the best Forex currency pairs for beginners.

- It teaches you some rules and tricks on money management. How much you should be spending and what will be your risk are some essential elements.

- Lastly, it teaches you about analyzing and how you need to document your results. This can help you to figure out your weaknesses as well as strengths.

Two Main Types of Trading Strategies

When you approach yourself in selecting the Forex trading strategies, you come across two major types of strategies as mentioned below:

- Paid Forex trading strategies

- Free to use Forex trading strategies

The major drawback of paid Forex trading strategies is that you have to spend a handsome amount of money in terms of searching or buying a strategy that does not fit according to your trading needs. Later on, after some time, you realize the fact that it does not suit your requirements and you are left with nothing but the regret wasting so much money. On the contrary, with the free Forex trading strategies, you have the option where you can take yourself on trial to test the strategy without paying a single penny.

Top Best Forex Trading Strategies To Earn Easily

1- Best Support & Resistance Trading Strategy

All the traders in Forex marketing, no matter whether they are professional or advanced beginners, they should know how to figure out the resistance and support levels in the middle of the charts. It is evident from the name, this category of Forex strategy is located on top of the price charts, and it usually acts as the barrier within the Forex market. You can get free daily Forex signals online with real-time. In simple terms, they will prevent different prices from either moving too much high or either moving too much low. If you want to predict the movements of cost in future, then choosing support and resistance Forex strategy is the best option for you. It is a powerful tool for successful Forex trading.

2- Superior Trend Trading Strategy

It is evident from the name that in this strategy, the prices will tend to move all the time in the trending chart and the idea is all about either to stay on the top or the bottom. This strategy will eventually help you to search for some trade entries by using some fantastic trading indicators. One of the most prominent indicators is RSI. RSI is the abbreviation of the Relative Strength Index, which will keep on moving in an upward and downward direction in the middle of 0-1000 scale. This will initially help you track down the strength of your currency pair. You can exit yourself from this Forex strategy by setting a stop and moving yourself to support and resistance strategy.

3- High-quality Fibonacci Trading Strategy

This has been one of the famous and top leading strategies in forex trading. It is named after a well-known Italian Mathematician named Fibonacci. It is a long term form of trading strategy that follows the rules of support and resistance strategy. This is one of the best strategies for the moment when marketing is trading so quickly. This is one of the best Forex trading platforms for beginners. Although for the beginners, this is a little overwhelming strategy to understand. Therefore it is mostly used by big traders or professionals who have a firm grip on its techniques.

4- Excellent Scalping Trading Strategy

Scalping has always remained one of the essential strategies in the forex trading market to achieve massive success in terms of earning. Mostly the beginners have a conception in mind that forex trading is all about risk trading, but this strategy will clear their myth. This strategy is basically about taking the range of profits on some small prices as soon as trading enters and become so much profitable. Scalping will bring fruitful results only by increasing the total number of winning trades and by reducing the size of wins. This strategy requires the traders typically to adopt a strictly based exit because more considerable losses will remove off the small benefits which they have achieved with so much hard work. It although demands for some patience and little bit awareness, but at the end of the day, it brings some practical results.

5- Candlestick Trading Strategy

Last, on our list of Forex trading strategies for beginners are about Candlestick strategy! This is one of the most common trading charts that are used in the trading business. You can even encounter some other trading charts as well, such as bar charts or line charts, but they will not make you learn so much about the trading prices and their movement. They will predict the future movement of the price based on their results from the past. This trading strategy will act as the movement for a specific period. It is one of the most effective tools where it can help you to indicate the different possibilities of entries as well as exists. This is the main reason that today it is one of the topmost favorites of advanced and professional traders. They are perfect to be used at the time of volatility as well as in less volatile times.

3 Comments

Thank you for another great article. The place else may just anybody

get that kind of information in such a perfect means of writing?

I’ve a presentation subsequent week, and I am on the search for such information.

One thing is that while you are searching for a education loan you may find that you’ll need a co-signer. There are many cases where this is true because you might find that you do not possess a past credit rating so the financial institution will require that you have someone cosign the loan for you. Interesting post.

Thank you, I have just been searching for information approximately this topic for a while and yours is the greatest I have discovered so far. However, what concerning the conclusion? Are you positive in regards to the source?